The digital money industry keeps on developing at a quick speed, carrying with it a large group of network safety challenges.

While practically all cryptographic forms of money are gotten by cryptography, which makes these computerized resources safe to hacks, fake, or twofold spend, the business stays defenseless against a scope of outside dangers.

Phishing assaults, malware, weaknesses in crypto wallets or trades, or imperfections in savvy contracts are some more eminent trouble spots that can demonstrate exorbitant for clients.

"The blockchain business faces developing network safety challenges, with the essential concern being vulnerability to hacks and misrepresentation because of the chance of taking resources by taking advantage of a weak link," Sipan Vardanyan, President and Prime supporter at crypto security firm Hexens, told Cryptonews.

Vardanyan noticed that decentralized innovations, for example, blockchain, assume a key part in upgrading online protection inside the cryptographic money biological system.

He called attention to that while these advances offer improved security by eliminating go-betweens, they additionally present novel dangers, remembering weaknesses for shrewd agreements and scaffolds.

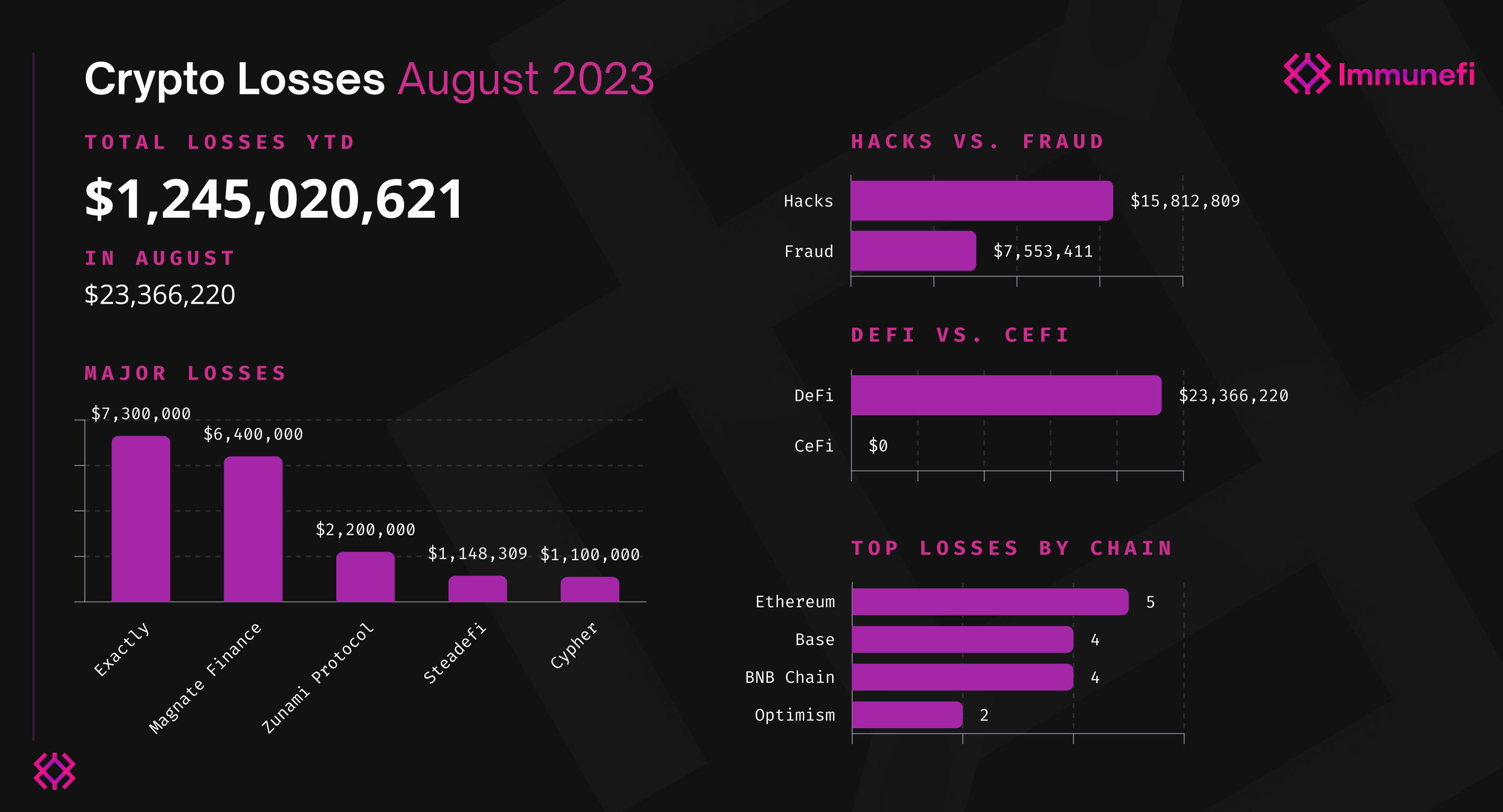

Up until this point this year, Web3 stages have lost more than $1.2 billion in hacks and floor covering pulls, as per a report from Web3 bug abundance stage Immunefi.

The report uncovered a sum of 211 separate episodes adding to this enormous total, with the long stretch of August alone representing $23.4 million in misfortunes.

The investigation uncovered that hacks were the predominant reason for monetary misfortunes, eclipsing misrepresentation.

In August, hacks were liable for a faltering $15.8 million in misfortunes, comprising a significant 67.7% of the all out month to month aggregate. Extortion represented $7.6 million, making up the leftover 32.3%.

Christian Seifert, previous Microsoft security lead and momentum specialist in Home at the Forta Organization, said the ascent of end-client designated tricks is the greatest test in the business.

"Here we have a great deal of criminal energy that is coordinated towards the new (we are somewhat new to this space) web3 client base in a climate that is unquestionably complicated with minimal implicit security layers," he said.

Crypto Security Stays a Basic Concern

Security has been one significant boundary to the more extensive reception of digital money, especially among institutional financial backers.

Large financial backers request strong safety efforts to defend their resources against burglary or digital dangers, and the absence of such measures has been driving away these financial backers from getting into the business.

While crypto security is unquestionably a basic concern, the business is still in its beginning phases with regards to safeguarding computerized resources, as per Vardanyan.

“With numerous hacks and exploits occurring, it’s evident that there’s a lot of work to be done to make the field safer.”

In the mean time, Seifert featured that there is a ton of development occurring in the crypto network safety space.

One of the most outstanding choices for those looking for additional security is Blockfence, which has made a program expansion that goes about as a defensive layer and prepares for suspect exchanges.

Blockfence consolidates complex examination with AI calculations and information on programmers and weaknesses accumulated by the Web3 people group to protect clients' exchanges.

It can forestall numerous sorts of assaults, including phishing assaults and malignant shrewd agreements.

Nonetheless, Seifert noticed that tricksters are not sitting inactive by the same token.

“We see them innovating and gaining expertise over time as well. If we leave them unchecked, it represents a serious risk to web3 as a whole.”

Best Practices for Further developing Security in Crypto

Cryptographic money financial backers are not completely helpless against uncontrolled security episodes.

As a matter of fact, clients can go to specific security lengths to make the most out of one of the quickest developing enterprises worldwide without stressing over losing their hand-procured computerized resources.

For people, Vardanyan suggests limiting outsider dangers by utilizing cold capacity arrangements like equipment wallets and rehearsing great functional security.

“Additionally, practicing good operational security (OpSec) is crucial; this includes using strong, unique passwords, enabling two-factor authentication, and being cautious of phishing attempts. Keep your private keys secure, ideally in offline, physically-protected storage.”

Besides, he stressed the significance of laying out a powerful security pipeline for associations, including thorough code survey processes, ordinary security reviews by respectable firms, and nonstop weakness observing.

In the mean time, Seifert urged clients to search out security layers to safeguard their property, for example, program modules and wallets with worked in security assurances.

"On the off chance that your wallet doesn't have implicit security insurances, ask your supplier for what valid reason that isn't true; change to a wallet, as Zengo, that does," he said.

By and by, for crypto to remain in front of developing dangers, there is a requirement for coordinated effort between security specialists and innovation trend-setters.

"Cooperation between security specialists and innovation pioneers is critical to remaining ahead in the always impacting universe of crypto security," Vardanyan said.

For those entering the crypto space, it is suggested that they do broad examination prior to drawing in with any digital currency venture or speculation.

They need to check an undertaking's security rehearses, group qualifications, and history.

With everything taken into account, as the digital currency industry keeps on developing, it faces advancing network protection challenges.

Nonetheless, a proactive methodology, nonstop development, and cooperation among specialists and industry partners can assist with handling this issue, shielding the eventual fate of digital money.