The UK FCA and Bank of Britain have delivered papers for criticism on stablecoin guidelines, expecting to guarantee safe future installment frameworks.

The FCA underscores that stablecoin backers ought to act to clients' greatest advantage, with the Bank of Britain thinking about administering installment frameworks.

The Bank of Britain cautions banks to obviously mark stablecoin stores and guarantee measures against tax evasion, liquidity, and illegal intimidation supporting.

The UK Monetary Direct Power (FCA) and the Bank of Britain (Bank) have opened input for two papers talking about stablecoin guidelines. The papers consider how these resources can be utilized securely for future installment frameworks on a framework wide scale.

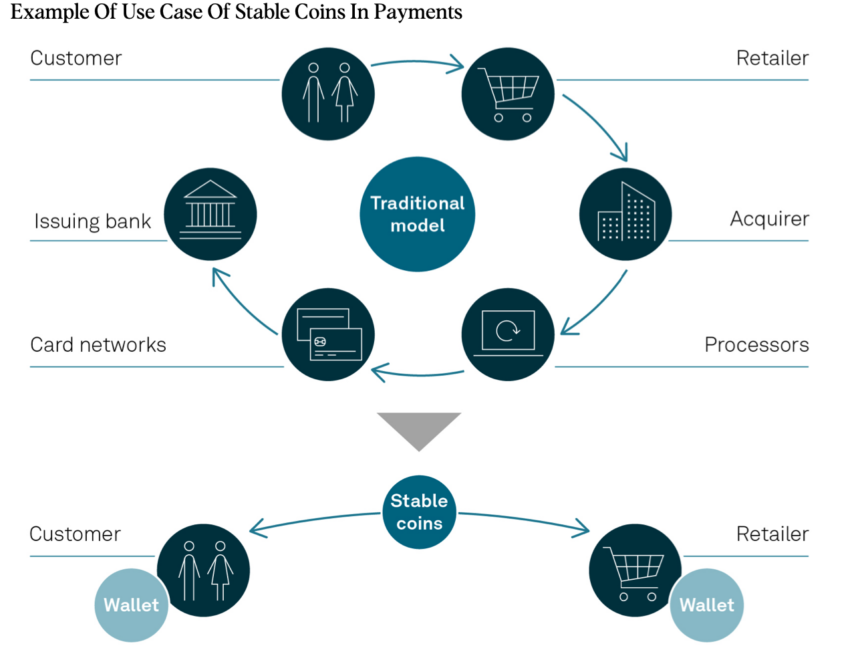

The paper from the FCA suggests that stablecoin guarantors guarantee "great results" for their clients. The Bank of Britain said stablecoins could improve advanced retail installments with firmer guidelines.

National Bank Could Regulate Stablecoin Backers

FCA leader chief Sheldon Factories said of the recommendation that stablecoins can make installments less expensive and quicker. To that end the public should assist with refining the principles expected to make such exchanges more secure.

"Stablecoins can possibly make installments quicker and less expensive for all, and that is the reason we need to offer firms the capacity to use this development securely and safely. Getting sees from others is fundamental for making proportionate standards that benefit customers and firms and furthermore meet our goals."

The FCA said that guarantors of stablecoins act to the greatest advantage of the client. The bank examined thoughts around how it would administer installment frameworks through its Prudential Guideline Authority, which polices monetary administrations.

The bank's paper cautioned banks to obviously stamp stablecoin stores to keep away from clients mistaking them for conventional stores. Banks and different backers ought to just issue stablecoins from non-store taking and bankruptcy far off substances.

Banks should likewise accept care to guarantee functional flexibility and go to lengths to battle tax evasion, liquidity, and psychological warfare supporting dangers. The remark time frame for the conversation papers will end on Feb. 6, 2024.

Stablecoins are advanced resources that track the worth of cash gave by legislatures. Their guarantors should save one unit of government issued money for each stablecoin they issue into the market.

Crypto trades can sell stablecoins to clients in return for fiat. To do this, trades frequently enroll the assistance of outsiders that work organizations to bring fiat esteem onto blockchains.